when are property taxes due in madison county illinois

In that same year property taxes accounted for 46 percent of localities revenue from their own sources and 27 percent of. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes.

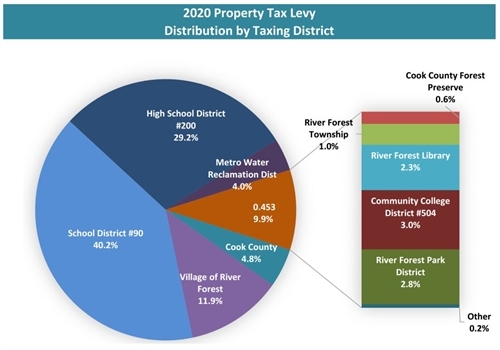

Property Tax Village Of River Forest

Cook County collects on average 138 of a propertys assessed fair market value as property tax.

. In fiscal year 2016 property taxes comprised 315 percent of total state and local tax collections in the United States more than any other source of tax revenue. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Property taxes are an important tool to help finance state and local governments.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

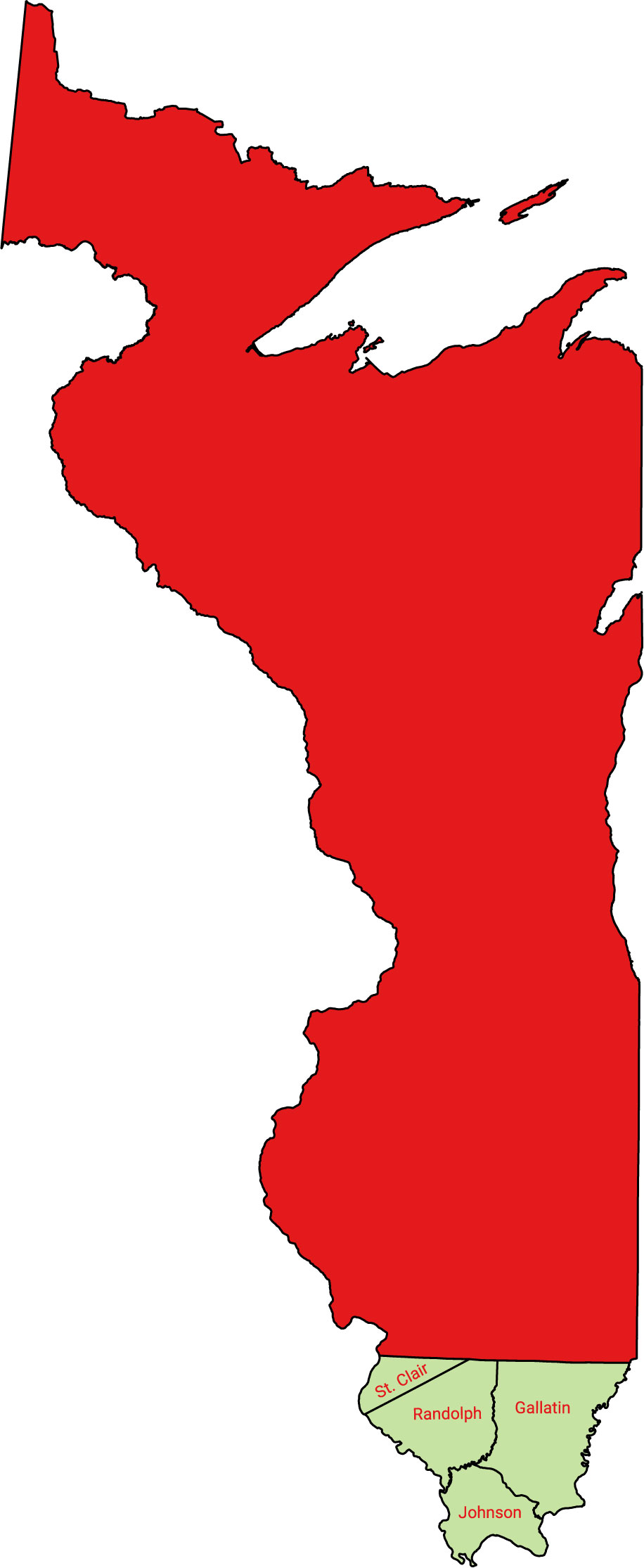

St Clair County Property Tax Inquiry

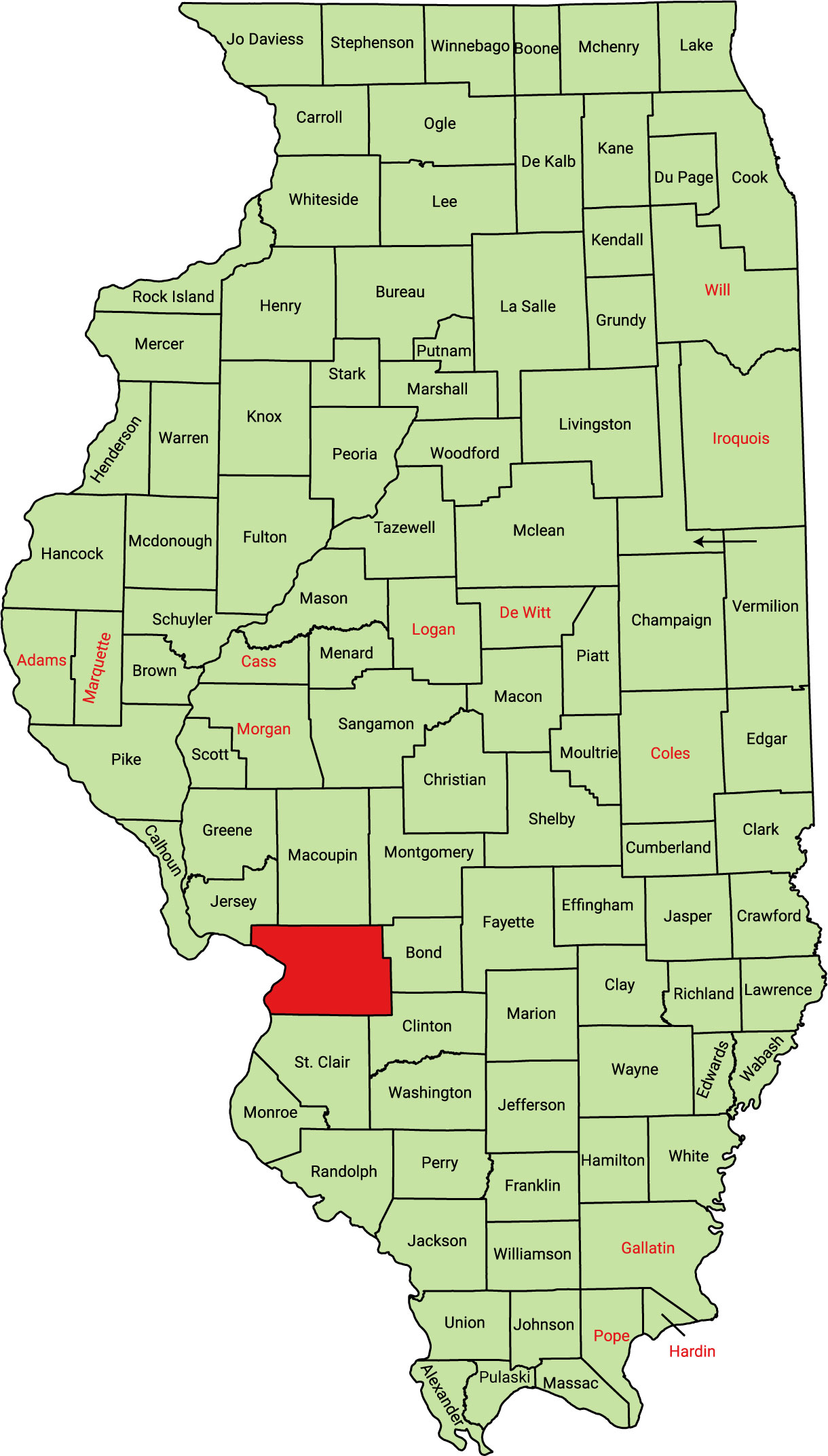

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical