proposed estate tax law changes 2021

Covid19njgov Call NJPIES Call Center for medical. The current 2021 gift and estate tax exemption is 117 million for each US.

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

To ensure fair property tax bills for all residents properties in the Township are revalued each year many based on an analysis of the real estate market but some by inspection.

. Under the 2018 law the inflation-adjusted lifetime transfer tax exemption is 117 million for an individual and 234 million for a married couple in 2021. July 14 2021 By Family Estate Planning Law Group. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

The Committee specifically proposed rolling back the 2017 Trump Tax Cuts. On Sunday September 12 2021 the House Ways Means Committee the Committee released draft legislation as part of Congress ongoing 35 trillion budget reconciliation process. NJ Revaluation and Reassessment Approval Lists.

As many of you may know administrations come and go and when they do it is prime time for law changes. September 15 2021. By the McNees Estate Planning Group.

The lifetime estate and generation-skipping transfer tax exemptions being reduced from their current level of 117 Million per person to 35 Million note that the exemptions are. Stay up to date on vaccine information. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

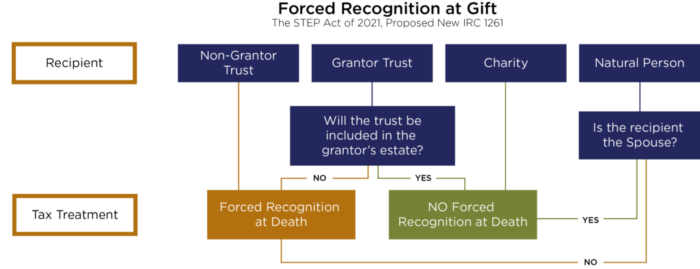

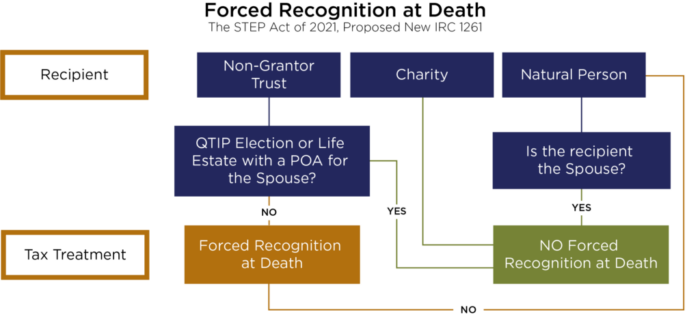

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Here are some of the possible changes that could take place if Sanders proposed tax changes become law. On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the.

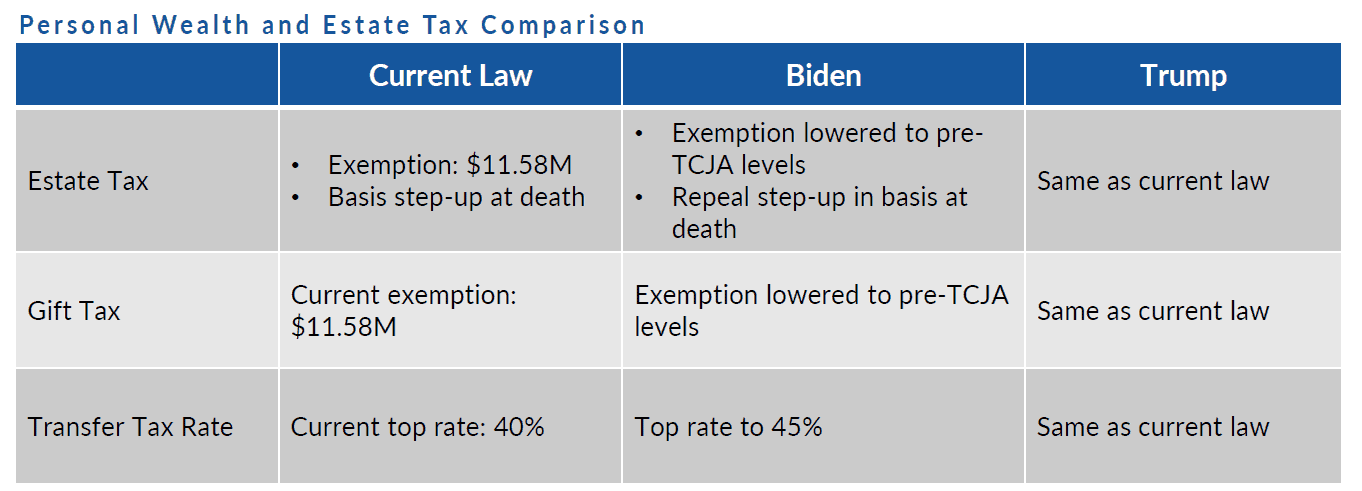

A memo prepared by the House Ways and Means Committee outlining the proposed tax law changes. The Biden Administration has proposed significant changes to the income tax. Here are two of the biggest proposed changes.

That is only four years away and. On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act detailing. The law would exempt the first 35 million dollars of an individuals.

President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these. COVID-19 is still active. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction.

We will mail checks to qualified applicants as. You are eligible for a property tax deduction or a property tax credit only if. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

Returning the estate tax and gift tax exemptions to 2009 levels 45 estate tax rate for estates over 35 million and 1 million for.

Looking Towards Estate Planning Changes Under New Administration Ross Law Firm Ltd

How Changes In Tax Laws Impact Your Estate Plan Snyder Law

Estate Tax Landscape For 2021 And Beyond

5 Things You Should Do Now To Prepare For Possible Estate Tax Law Changes Sessa Dorsey

Estate Tax Law Changes Are On Hold For Now

Estate Tax Law Changes Could Have Costly Implications Uhy

How Could We Reform The Estate Tax Tax Policy Center

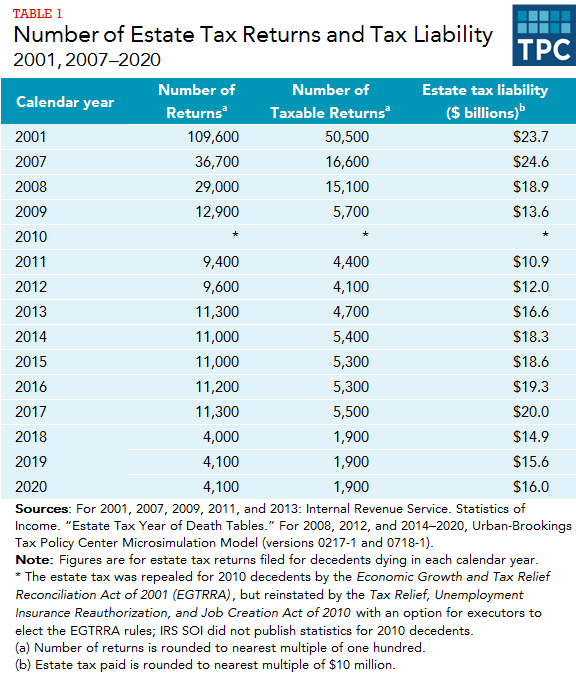

How Many People Pay The Estate Tax Tax Policy Center

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Your Fair Share Changes To Income Gains And Estate Taxes Open Window

Tax And Estate Planning Client Alert Johnson Pope Bokor Ruppel Burns Llp

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

House Democrats Plan Drops Repeal Of A Tax Provision For Inheritances

How Your Estate Plan Is Impacted By The Proposed Tax Law Changes Youtube

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Summary Of Fy 2022 Tax Proposals By The Biden Administration